Quotes - From Prominent People

VOLTAIRE (1694-1778)

Paper money eventually returns to its intrinsic value ---- zero."

"Whoever controls the volumn of money in any country is absolute master of all industry and commerce."

Slavery (Photo credit: quadelirus)

HORACE GREELY

"While boasting of our noble deeds, we are careful to control the ugly fact that by an iniquitous money system, we have nationalized a system of oppression which, though more refined, is not less cruel than the old system of chattel slavery."

"Those who create and issue money and credit direct the policies of government and hold in the hollow of their hands the destiny of the people."

SIR JOSIAH STAMP, (President of the Bank of England in the 1920's, the second richest man in Britain)

"Banking was conceived in iniquity, and was born in sin. The Bankers own the Earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen, they will create enough deposits, to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But if you wish to remain the slaves of Bankers, and pay the cost of your own slavery, let them continue to create deposits."

"Those few who can understand the system (check book money and credit) will either be so interested in its profits, or so dependent on it favors, that there will be little opposition from that class, while on the other hand, the great body of people mentally incapable of comprehending the tremendous advantage that capital derives from the system, will bear it burdens without complaint, and perhaps without even suspecting that the system is inimical to their interests."

ANSELM ROTHSCHILD

"Give me the power to issue a nation's money; then I do not care who makes the law."

English: Woodrow Wilson. (Photo credit: Wikipedia)

"A great industrial nation is controlled by its system of credit. Our system of credit is concentrated. The growth of the Nation and all our activities are in the hands of a few men. We have come to be one of the worst ruled, one of the most completely controlled and dominated governments in the world--no longer a government of free opinion, no longer a government of conviction, and vote of the majority, but a government by the opinion and duress, of small groups of dominant men."

Just before President Woodrow Wilson died, he is reported to have stated to friends that he had been "deceived" and that "I have betrayed my Country". referring to the Federal Reserve Act, passed during his Presidency.

PELATIAH WEBSTER

"Paper money polluted the equity of our laws, turned them into engines of oppression, corrupted the justice of our public administration, destroyed the fortunes of thousands who had confidence in it, enervated the trade, husbandry, and manufactures of our country, and went far to destroy the morality of our people."

WILLIAM PATTERSON

"The bank hath benefit of interest on all moneys which it creates out of nothing."

"In the first place, then, it is patent that in our days, not wealth alone is accumulated, but immense power and despotic economic domination are concentrated in the hands of the few, who for the most part are not the owners but only the trustees and directors of invested funds, which they administer at their own good pleasure…This domination is most powerfully exercised by those who, because they hold and control money, also govern credit and determine its allotment, for that reason supplying so to speak, the life blood of the entire economic body, and grasping in their hands, as it were, the very soul of production, so that no one can breathe against their will…"

IRVING FISHER

"Thus, our national circulating medium is now at the mercy of loan transactions of banks, which lend, not money, but promises to supply money they do not possess."

MAJOR L. L. B. ANGUS

"The modern banking system manufactures money out of nothing. The process is, perhaps, the most, astounding piece of sleight of hand that was ever invented. Banks can in fact inflate, mint, and un-mint the modern ledger-entry currency".

RALPH M. HAWTREY, (Former Secretary of the British Treasury)

"Banks lend by creating credit. They create the means of payment, out of nothing."

ROBERT H. HEMPHILL (Credit Manager of Federal Reserve Bank, Atlanta, Georgia)

"This is a staggering thought. We are completely dependent, on the Commercial Banks. Someone has to borrow every dollar, we have in circulation, cash or credit. If the Banks create ample synthetic money, we are prosperous; if not, we starve. We are, absolutely, without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity, of our hopeless position, is almost incredible, but there it is. It is the most, important subject, intelligent persons can investigate and reflect upon. It is so important that our present civilization may collapse, unless it becomes widely understood, and the defects remedied very soon."

CONGRESSMAN LOUIS T. McFADDEN and former Chairman of the Committee on Banking and Currency.

" . . . we have in this Country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks. . . . This evil institution has impoverished and ruined the people of the United States. . . . Some people think the Federal Reserve Banks are United States Government institutions. They are private credit monopolies which prey upon the people of the United States for the Benefit of themselves and their foreign customers. ..."

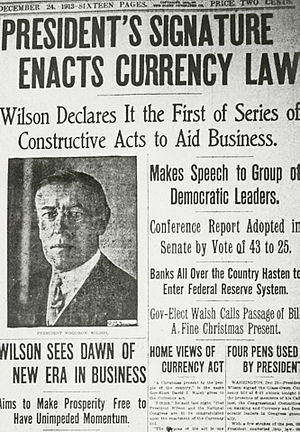

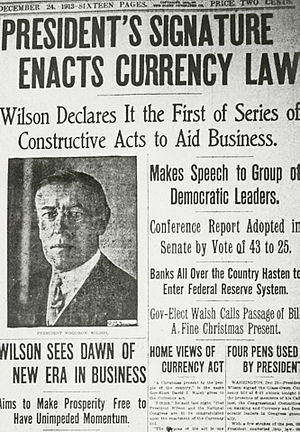

Description: Newspaper clipping USA, Woodrow Wilson signs creation of the Federal Reserve. Source: Date: 24 December 1913 (Photo credit: Wikipedia)

"The Federal Reserve (Banks) are one of the most corrupt institutions, the world has ever seen. There is not a man, within the sound of my voice, who does not know that this Nation is run by the International Bankers".

"Mr. Chairman, we have in this country one of the most corrupt institutions the world has ever known. I refer to the Federal Reserve Board and the Federal Reserve Banks, hereinafter called the Fed. The Fed has cheated the Government of the United States and the people of the United States out of enough money to pay the Nation's debt.... The wealth of these United States and the working capital have been taken away from them and has either been locked in the vaults of certain banks and the great corporations or exported to foreign countries for the benefit of foreign customers of these banks and corporations. So far as the people of the United States are concerned, the cupboard is bare."

"When the Federal Reserve Act was passed, the people of these United States did not perceive that a world banking system was being set up here. A super-state controlled by international bankers and industrialists...acting together to enslave the world...Every effort has been made by the Fed to conceal its powers but the truth is--the Fed has usurped the government."

JAMES MADISON

"The prime function of government is the protection of the different and unequal faculties of men for acquiring property."

"History records that the money changers have used every form of abuse, intrigue, deceit, and violent means possible to maintain their control over governments by controlling money and its issuance."

"The extension of the prohibition to bills of credit must give pleasure to every citizen, in proportion to his love of justice and his knowledge of the true springs of public prosperity. The loss which America has sustained since the peace from the pestilent effects of paper money on the necessary confidence between man and man, on the necessary confidence in the public councils, on the industry and morals of the people and on the character of republican government, constitutes an enormous debt against the States chargeable with this ill-advised measure, which must long remain unsatisfied; or rather an accumulation of guilt, which can be expiated no otherwise than by a voluntary sacrifice on the altar of justice of the power which has been the instrument of it. In addition to these persuasive considerations, it may be observed that the same reasons which show the necessity of denying to the States the power of regulating coin, prove with equal force that they ought not to be at liberty to substitute a paper medium in the place of the coin." Number 44 of the Federalist Papers.

"Paper money may be deemed an aggression on the rights of the other states."

ALEXANDER HAMILTON

"To emit an unfunded paper as the sign of value ought not to continue a formal part of the Constitution, nor even after this... takes effect to be employed; being, in its nature, pregnant with abuses, and liable to be made the engine of imposition and fraud; holding out temptations equally pernicious to the integrity of government and to the morals of the people."

ANDREW JACKSON

"If congress has the right under the Constitution to issue paper money, it was given them to use themselves, not to be delegated to individuals or corporations.

"The bold efforts that the present bank has made to control the government and the distress it has wantonly caused, are but premonitions of the fate which awaits the American people should they be deluded into a perpetuation of this institution or the establishment of another like it...If the people only understood the rank injustice of our money and banking system there would be a revolution before morning."

FROM A SECRET AGENT - 1862

"Slavery is likely to be abolished by the war power and all chattel slavery abolished. This I and my European friends are in favor of, for slavery is but the owning of labour and carries with it the care of the labourers, while the European plan, led on by England, is that capital shall control labour by controlling wages. The great debt that the capitalists will see to it is made out of the war, must be used as a means to control the volume of money. To accomplish this the bonds must be used as a banking basis. We are now waiting for the Secretary of the Treasury to make this recommendation to Congress. It will not do to allow the green-back, as it is called, to circulate as money any length of time, as we can not control that. But we can control the bonds and through them the bank issues."

Abraham Lincoln (Photo credit: casually_cruel)

ABRAHAM LINCOLN

"There should be no war upon property or the owners of property. Property is the fruit of labour; property is desirable; is a positive good in the world. That some should be rich shows that others may become rich, hence, is just encouragement to industry and enterprise."

"I have two great enemies: the Southern Army in front of me, and the financial institutions to my rear. Of the two, the one in my rear is my greatest foe..."

"The Government should create, issue, and circulate all the currency and credits needed to satisfy the spending power of the Government and the buying power of consumers. By the adoption of these principles, the taxpayers will be saved immense sums of interest. Money will cease to be master and become the servant of humanity.

"Yes; we may all congratulate ourselves that this cruel war is nearing its close. It has cost a vast amount of treasure and blood. The best blood of the flower of American youth has been freely offered upon our country's altar that the Nation might live. It has been, indeed a trying hour for the Republic; but I see in the future a crisis approaching that unnerves me and causes me to tremble for the safety of my country. As a result of the war, corporations have been enthroned and an era of corruption in high places will follow, and the money power of the country will attempt to prolong its reign by working upon the prejudices of the people until wealth is aggregated in a few hands and the Republic is destroyed. I feel at this moment more anxiety for the safety of my country than ever before, even in the midst of the war."

"I see in the near future a crisis approach which unnerves me and cause me to tremble for the safety of my country. Corporations (of banking) have been enthroned, an era of corruption in high places will follow, and the money power of the country will attempt to prolong its reign by working upon the prejudices of the people until the wealth is aggregated in a few hands and the Republic destroyed."

SALMON P. CHASE, (Lincoln's Secretary to the Treasury) who was the pilot of the 1863 banking act in the US never forgave himself, subsequently saying:

"My agency, in promoting the passage of the National Bank Act, was the greatest mistake in my life. It has built up a monopoly which affects every interest in the country. It should be repealed, but before that can be accomplished, the people should be arrayed on one side, and the banks on the other, in a contest such as we have never seen before in this country."

OTTO VON BISMARCK, German Chancellor (1815-1898)

"The death of Lincoln was a disaster for Christendom. There was no man in the United States great enough to wear his boots and the bankers went anew to grab the riches. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America and use it to systematically corrupt modern civilization."

LONDON TIMES -1865

"If this mischievous financial policy [of creating a debt-free currency], which has its origin in the American Republic, shall become permanent, then that government will give its own money without cost! It will pay off its debts and be without debt. It will have all the money necessary to carry on its commerce. It will become prosperous without precedent in the history of the world. The brains and the wealth of all countries will go to America. That government must be destroyed or it will destroy every monarchy on the globe!"

JOHN C. CALHOUN

"A power has risen up in the government greater than the people themselves, consisting of many and various powerful interests joined in one mass, and held together by the cohesive power of the vast surplus in the banks."

LEON N. TOLSTOY

"Money is a new form of slavery, and distinguishable from the old simply by the fact that it is impersonal -- that there is no human relation between master and slave."

Frederic Bastiat, The Law

"When plunder becomes a way of life for a group of men living together in society, they create for themselves in the course of time a legal system that authorizes it and a moral code that glorifies it."

WN. COBBETT

" I set to work to read the Act of Parliament by which the Bank of England was created in 1694. The inventors knew well what they were about. Their design was to mortgage by degrees the whole of the country, all the lands, all the houses, and all other property, and even all labor, to those who would lend their money to the State—the scheme, the crafty, the cunning, the deep scheme has produced what the world never saw before—starvation in the midst of plenty."

DARRYL R. FRANCIS, former President of the Federal Reserve Bank of St. Louis

"Since the direct method of printing money to finance government expenditures is prohibited in the United states, the monetization of government deficits has occurred indirectly . . . government debt is ultimately being financed by the creation of new money . . . I doubt that monetization of debt has a conscious act . . . I can find no benefits accuring to the whole of society from debt monetization, but the risks are very serious and can be expressed in one word, inflation" "In the case of debt monetization the immediate and even the short run impact is neither an increase in interest rates, and yet real resources are still being transferred from private to government use."

"Federal Reserve System" Bd. of Gov.'s

"....in the practical workings of the banking system the bulk of deposits originates in the granting of loans...., and his ability to make loans and investments arises largely from the receipt of his depositors' money."

"As we realize that banks create their own deposit debts....we begin to see why these institutions are often called monetizer's of debt..."

Federal Reserve Bank of Chicago, Modern Money Mechanics,

"The actual process of money creation takes place in commercial banks. As noted earlier, demand liabilities of commercial banks are money.",

"Confidence in these forms of money also seems to be tied in some way to the fact that assets exist on the books of the government and the banks equal to the amount of money outstanding, even though most of the assets themselves are no more than pieces of paper--.",

"Commercial banks create check-book money when they grant a loan, simply by adding new deposit dollars in accounts on their books in exchange for a borrower's IOU.",

"The 12 regional reserve banks aren't government institutions, but corporations nominally 'owned' by member commercial banks.", p. 27.

St. Louis Federal Reserve Bank, Review, Nov. 1975.

"The decrease in purchasing power incurred by holders of money due to inflation imparts gains to the issuers of money--."

Federal Reserve Bank of Philadelphia, Gold.

"Without the confidence factor, many believe a paper money system is liable to collapse eventually."

Federal Reserve Bank, New York

"Because of 'fractional' reserve system, banks, as a whole, can expand our money supply several times, by making loans and investments."

"Commercial banks create checkbook money when they grant a loan, simply by adding new deposit dollars in accounts on their books in exchange for a borrower's IOU."

Federal Reserve Bank of Chicago

"The actual process of money creation takes place in commercial banks. As noted earlier, demand liabilities of commercial banks are money."

ROBERT HEMPHILL, former Credit Manager of the Federal Reserve Bank in Atlanta.

"If all the bank loans were paid, no one could have a bank deposit, and there would not be a dollar of coin or currency in circulation. This is a staggering thought. We are completely dependent on the commercial banks. Someone has to borrow every dollar we have in circulation, cash, or credit. If the banks create ample synthetic money we are prosperous; if not, we starve. We are absolutely without a permanent money system. When one gets a complete grasp of the picture, the tragic absurdity of our hopeless situation is almost incredible-but there it is."

WALTER WRISTON, former chairman of the Citicorp Bank

"If we had a truth-in-Government act comparable to the truth-in-advertising law, every note issued by the Treasury would be obliged to include a sentence stating: "This note will be redeemed with the proceeds from an same note which will be sold to the public when this one comes due." When it is carried out in the United States, as it is weekly, it is described as a Treasury bill auction. But when basically the same process is conducted abroad in a foreign language, our news media usually speak of a country's "rolling over its debts." The perception remains that some form of disaster is inevitable. It is not. To see why, it is only necessary to understand the basic facts of government borrowing. The first is that there are few recorded instances in history of government-any government-actually getting out of debt. Certainly in an era of $100-billion deficits, no one lending money to our Government by buying a Treasury bill expects that it will be paid at maturity in any way except by our Government's selling a new bill of like amount."

MERRILL JENKINS SR.

"The right of distribution over private property is the essence of freedom."

"Force- modern Money, then, has the power to create debt since it can command other goods, but is valueless itself. Money has purchasing power, but no value -- without purchasing power.. Fed. "Notes" must be accepted as a tender for debt, but are not "money" -- so therefore --do not have money's unique ability called purchasing power, what thing has purchasing power? what thing can force the public to offer its property and rights. Offer means to present for action or consideration; propose; suggest; it is a voluntary act. What thing can 'force' anyone into a voluntary act of offering. The words force and voluntary are exactly opposed and it is by the acceptance of this impossible concept of 'voluntary force' being 'purchasing power' that makes the public believe that something must be 'money' and have this unique power." .

Congressman Jerry Voorhis

"The banks -- commercial banks and the Federal Reserve -- create all the money of this nation and its people pay interest on every dollar of that newly created money. Which means that private banks exercise unconstitutionally, immorally, and ridiculously the power to tax the people. For every newly created dollar dilutes to some extent the value of every other dollar already in circulation."

RUSSELL L.MUNK, former Assistant General Counsel, Department of the Treasury

"Federal Reserve Notes are not dollars."

PRESIDENT JOHN ADAMS

"All the perplexities, confusions and distresses in America arise not from defects in the constitution or confederation, not from want of honor or virtue, as much as from downright ignorance of the nature of coin, credit and circulation."

Constitution of the United States of America (Photo credit: The U.S. National Archives)

THE CONSTITUTION OF THE UNITED STATES OF AMERICA

"No State shall enter into any treaty, alliance, or confederation; grant letters of marque and reprisal; coin money; emit letters of credit; make any thing but gold and silver coin a tender in payment of debts; pass any bill of attainder, ex post facto law, or law impairing the obligation of contracts, or grant any title of nobility." (Article I, Section 10)

U.S. Supreme Court, Craig v. Missouri, 4 Peters 410.

"Emitting bills of credit, or the creation of money by private corporations, is what is expressly forbidden by Article 1, Section 10 of the U.S. Constitution."

George Bancroft

"Madison, agreeing with the journal of the convention, records that the grant of power to emit bills of credit was refused by a majority of more than four to one. The evidence is perfect; no power to emit paper money was granted to the legislature of the United States."

JOHN FISKE

"It was finally decided, by the vote of nine states against New Jersey and Maryland, that the power to issue inconvertible paper should not be granted to the federal government. An express prohibition, such as had been adopted for the separate states, was thought unnecessary. It was supposed that it was enough to withhold the power, since the federal government would not venture to exercise it unless expressly permitted in the Constitution. "Thus," says Madison, in his narrative of the proceedings, "the pretext for a paper currency, and particularly for making the bills a tender, either for public or private debts, was cut off." Nothing could be more clearly expressed than this. As Mr. Justice Field observes, in his able dissenting opinion in the recent case of Juilliard vs. Greenman, "if there be anything in the history of the Constitution which can be established with moral certainty, it is that the framers of that instrument intended to prohibit the issue of legal-tender notes both by the general government and by the states, and thus prevent interference with the contracts of private parties." Such has been the opinion of our ablest constitutional jurists, Marshall, Webster, Story, Curtis, and Nelson. There can be little doubt that, according to all sound principles of interpretation, the Legal Tender Act of 1862 was passed in flagrant violation of the Constitution."

CONGRESSIONAL RECORD, MAY 11, 1972

"Some people think the Federal Reserve Banks are United States government institutions, they are not government institutions, they are private credit monopolies."

CONGRESSIONAL RECORD, JUNE 10, 1932.

"The Federal Reserve Board, and the Federal Reserve Banks are private Corporations."

John Maynard Keynes Русский: Джон Мейнард Кейнс Türkçe: John Maynard Keynes (Photo credit: Wikipedia)

JOHN MAYNARD KEYNES, (chief architect of our current fiat-paper money system)

"By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens"

"If governments should refrain from regulation..... the worthlessness of the money becomes apparent and the fraud upon the public can be concealed no longer"

"Lenin is said to have declared that the best way to destroy the Capitalistic System was to debauch the currency. . . Lenin was certainly right. There is no subtler, no surer means of overturning the existing basis of society than to debauch the currency. The process engages all the hidden forces of economic law on the side of destruction, and does it in a manner which not one man in a million can diagnose."

CHARLES LINDBERG

"Ever since the Civil War, Congress has allowed the bankers to control financial legislation. The membership of the Finance Committee in the Senate (now the Banking and Currency Committee) and the Committee on Banking and Currency in the House have been made up chiefly of bankers, their agents, and their attorneys. ...In this way the committees have been able to control legislation in the interests of the few."

"This Act (Federal Reserve Act) establishes the most gigantic trust on earth. When the President signs this bill, the invisible government by the Monetary Power will be legalized... The worst legislative crime of the age is perpetrated by this banking and currency bill. The caucus of the party bosses have again operated and prevented the people from getting the benefits of their own government."

BENJAMIN DISRAELI, former British Prime Minister

"The world is Governed by very different personages from what is imagined by those who are not behind the scenes."

WILLIAM JENNINGS BRYAN

"Money power denounces, as public enemies, all who question its methods or throw light upon its crimes."

JOHN F. KENNEDY

"The great free nations of the world must take control of our monetary problems if these problems are not to take control of us."

ERNEST HEMINGWAY

"The first panacea for a mismanaged nation is inflation of the currency; second is war. Both bring a temporary (and false) prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunities."

THE RT. HON. REGINALD MCKENNA (one-time British Chancellor of the Exchequer, and Chairman of the Midland Bank)

"I am afraid the ordinary citizen will not like to be told that the banks can, and do, create and destroy money. The amount of finance in existence varies only with the action of the banks in increasing or decreasing deposits and bank purchases. We know how this is effected. Every loan, overdraft or bank purchase creates a deposit, and every repayment of a loan, overdraft or bank sale destroys a deposit."

"And they who control the credit of the nation direct the policy of governments, and hold in the hollow of their hands the destiny of the people."

JOHN B. RARICK

"Mr. Speaker, the current efforts by our Government to hold down price increases have served to focus the attention of thoughtful students on a little discussed facet of our money system, this system, because of a long procedure of mis-education and studied silence, is not now understood as it was prior to the adoption of the Federal Reserve system more than half a century ago. It is based upon debt; has serious implications for the future of our country, and invites what may be the greatest war in history. ... Every debt Dollar demands an interest tribute from our economy for every year that Dollar remains in circulation. These interest costs force up the price of every commodity and service and contribute greatly to inflation. ..."

"Under the Constitution, the Congress has responsibility of issuing the nation's money and regulating its value Art. 1, Sec 8, Cl. 5, in a recent brilliant analysis of our money system by T. David Horton, Chairman of the Executive Council of the Defenders of the American Constitution, able Lawyer and keen student of basic American history, he suggests a proven remedy for our current predicament that will enable the Congress to resume its Constitutional responsibilities to regulate our nation's money by liberating our economy from the swindle of the debt-money manipulators by the issuance of national currency in debt fee form ... We have a certain amount of non-interest bearing money in circulation, all of our fractional currency, pennies, nickels, dimes, quarters, and half dollars. They are manufactured in our mints, and are paid into circulation, circulate freely, and provide the government with a valuable source of revenue. From 1966 through 1970 the amount of seignorage paid into the treasury by the mints amounted to in excess of 4 billion dollars the profit ratio on this type of currency is 6 to 1, or currency 6 times the cost of production. The cost ration for Federal Reserve Notes is 600 to 1; however, during these same four years, 1986 through 1970, 50 billion dollars in Federal Reserve Notes were manufactured by the bureau of printing and engraving and turned over to the banks; not one cent in seignorage was paid over to the treasury. ... Our Debt money system compels the government to spend more than it takes in, because this is the only way we can keep the economy going..."

George Washington (Photo credit: Joye~)

GEORGE WASHINGTON

"Every lover of his country will therefore be solicitous to find out some speedy remedy for this alarming evil. There is no possible substitute for the loss of commerce. Our first grand object, therefore, it its restoration. I presume not to dictate or direct. It is a subject that will require the deepest deliberations and researches of the wisest and more experienced men in America to fully comprehend. It probably belongs to no one man existing to possess all the qualifications required to trace the course of American commerce through all intricate paths and to those and only those that shall lead the United States to future glory and prosperity I am sanguine in the belief of the possibility that we may one day become a great commercial and flourishing nation. But if in the pursuit of the means we should unfortunately stumble again on unfunded paper money or any similar species of fraud, we shall assuredly give a fatal stab to our national credit in its infancy. Paper money will invariably operate in the body of politics as spirit liquors on the human body. They prey on the vitals and ultimately destroy them."

"Paper money has had the effect in your state that it will ever have, to ruin commerce, oppress the honest, and open the door to every species of fraud and injustice." (letter to J. Bowen, Rhode Island, Jan. 9, 1787)

"If ever again our nation stumbles upon unfunded paper, it shall surely be like death to our body politic. This country will crash."

JERRY JORDAN, Cleveland Fed Res Bank President

"The failed attempts at influencing real economic activity during the late 1960's and 1970's are a clear warning of the damaging power of the central bank."

DENNIS KARNOFSKY, Chief economic adviser St. Louis Federal Reserve Bank

"....what is a dollar its just something artificial we throw out there....what youre doing is youre fooling people...."

LAWRENCE PARKS, Executive Director, FAME

"Bypassing voters, taxpayers and the public at large, Congress has delegated to the Fed a power that the Congress itself does not have."

LUDWIG VON MISES

"Government is the only agency which can take a useful commodity like paper, slap some ink on it and make it totally worthless."

DANIEL WEBSTER

"No other rights are safe where property is not safe:"

"Of all the contrivances devised for cheating the laboring classes of mankind, none has been more effective than that which deludes him with paper money."

We are in danger of being overwhelmed with irredeemable paper, mere paper, representing not gold nor silver; no sir, representing nothing but broken promises, bad faith, bankrupt corporations, cheated creditors and a ruined people."

THE BIBLE

"If thou lend money to any of my people who is poor by thee, thou shalt not be to him an usurer, neither shalt thou lay upon him usury." Exodus 22:25

"Take no usury of him, or increase ... thou shalt not give him thy money upon usury." Leviticus 25:36-37

"Unto thy brother thou shalt not lend upon usury: That the Lord they God bless thee." Deuteronomy 23:20

"The rich rule over the poor, and the borrower is a servant to the lender." Proverbs 22.7

"The stranger that is within thee shall get up above thee very high, and thou shalt come down very low. He shall lend to thee, and thou shalt not lend to him; he shall be the head, and thou shalt be the tail." Deut. 28:44-45

PELATIAH WEBSTER

"Paper money polluted the equity of our laws, turned them into engines of oppression, corrupted the justice of our public administration, destroyed the fortunes of thousands who had confidence in it, enervated the trade, husbandry, and manufactures of our country, and went far to destroy the morality of our people."

Benjamin Franklin (Photo credit: elycefeliz)

BENJAMIN FRANKLIN

"The refusal of King George to operate an honest colonial money system which freed the ordinary man from the clutches of the manipulators was probably the prime cause of the Revolution."

"The Colonies would gladly have borne the little tax on tea and other matters, had it not been that England took away from the Colonies their money, which created unemployment and dis-satisfaction."

THOMAS JEFFERSON

"The system of banking we have both equally and ever reprobated. I contemplate it as a blot left in all our constitutions, which, if not covered, will end in their destruction, ... I sincerely believe, with you, that banking establishments are more dangerous than standing armies; and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large-scale."

"The eyes of our citizens are not sufficiently open to the true cause of our distress. They ascribe them to everything but their true cause, the banking system; a system which if it could do good in any form is yet so certain of leading to abuse as to be utterly incompatible with the public safety and prosperity. I sincerely believe that banking establishments are more dangerous than standing armies... and that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large-scale."

"... we must not let our rulers load us with perpetual debt...If we run into such debts as that we must be taxed in our meat and in our drink, in our necessities and comforts, in our labors and in our amusements, for our callings and our creeds...our people...must come to labor 16 hours in the 24, give the earnings of 15 of these to the government for their debts and daily expenses; and the 16th being insufficient to afford us bread,...We have no time to think, no means of calling the mis-managers to account; but be glad to obtain subsistence by hiring ourselves, to rivet their chains on the necks of our fellow sufferers. Our land holders, too...retaining indeed the title and stewardship of estates called theirs, but held really in trust for the treasury,. . .this is the tendency of all human governments. A departure from principle becomes a precedent for a second; that second for a third; and so on, till the bulk of society is reduced to mere automatons of misery, to have no sensibilities left but for sinning and suffering...And the fore horse of this frightful team is public debt. Taxation follows that, and in its train, wretchedness and oppression."

"I believe that banking institutions are more dangerous to our liberties than standing armies. Already they have raised up a money aristocracy that has set the government at defiance. This issuing power should be taken from the banks and restored to the people to whom it properly belongs. If the American people ever allow private banks to control the issue of currency, first by inflation, then by deflation, the banks and corporations that will grow up around them will deprive the people of all property until their children will wake up homeless on the continent their fathers conquered. I hope we shall crush in its birth the aristocracy of the moneyed corporations which already dare to challenge our Government to a trial of strength and bid defiance to the laws of our country"

I sincerely believe ... that banking establishments are more dangerous than standing armies, and that the principle of spending money to be paid by posterity under the name of funding is but swindling futurity on a large-scale."

I place economy among the first and important virtues, and public debt as the greatest of dangers. To preserve our independence, we must not let our

rulers load us with perpetual debt. We must make our choice between economy and liberty, or profusion and servitude. If we can prevent the government

from wasting the labours of the people under the pretense of caring for them, they will be happy.

"The Central Bank is an institution of the most deadly hostility existing against the principles and form of our Constitution."

GEORGE BANCROFT

"Madison, agreeing with the journal of the convention, records that the grant of power to emit bills of credit was refused by a majority of more than four to one. The evidence is perfect; no power to emit paper money was granted to the legislature of the United States."

Thomas Alva Edison photo and signature. 1915. Русский: Автограф и фотопортрет Томаса Альвы Эдисона, американского изобретателя. 1915 (Photo credit: Wikipedia)

THOMAS A. EDISON

"People who will not turn a shovel of dirt on the project, nor contribute a pound of material, will collect more money, from the United States, than will the people, who supply all the material and do all the work. This is the terrible thing about interest (usury) ... But here is the point: If the nation can issue a dollar bond, it can also issue a dollar bill. The element that makes the bond good, makes the bill good, also. The difference, between the bond and the bill, is that the bond lets the money-broker collect twice the amount of the bond, and an additional 20%. Whereas the currency, the honest sort, provided by the Constitution, pays nobody, but those, who contribute in some useful way. It is absurd, to say that our country can issue bonds, and cannot issue currency. Both are promises to pay, but one fattens the usurer and the other helps the people. If the currency issued by the people were no good, then the bonds would be no good, either. It is a terrible situation, when the Government, to insure the national wealth, must go in debt and submit to ruinous interest charges, at the hands of men, who control the fictitious value of gold. Interest is the invention of Satan."

Mr Phillip A. Benson, President of the American Bankers' Association, June 8 1939

"There is no more direct way to capture control of a nation than through its credit (money) system."

F.A. HAYEK

"The history of government management of money has, except for a few short happy periods, been one of incessant fraud and deception."

DR. PAUL HEIN

"Freedom and fiat are incompatible; slavery and scrip are bedfellows."

"Inflation (caused by paper money) is an evil which exerts its baleful influence throughout society. Gold and silver were gifts of God, and, short of the labor required to obtain them, were ours free. They didn't have to be returned to the source, much less with interest! Inflation, on the other hand, is borrowed into existence from a privileged clique who, by the very nature of the process, enslave those who use it."

USA Banker's Magazine, August 25 1924

"Capital must protect itself in every possible manner by combination and legislation. Debts must be collected, bonds and mortgages must be foreclosed as rapidly as possible. When, through a process of law, the common people lose their homes they will become more docile and more easily governed through the influence of the strong-arm of government, applied by a central power of wealth under control of leading financiers. This truth is well-known among our principal men now engaged in forming an imperialism of Capital to govern the world. By dividing the voters through the political party system, we can get them to expend their energies in fighting over questions of no importance. Thus by discreet action we can secure for ourselves what has been so well planned and so successfully accomplished."

Treasury Secretary Woodin, 3/7/1933

"Where would we be if we had I.O.U.'s scrip and certificates floating all around the country?" Instead he decided to "issue currency against the sound assets of the banks. The Federal Reserve Act lets us print all we'll need. And it won't frighten the people. It won't look like stage money. It'll be money that looks like real money." The Bank Holiday of 1933'

English: U.S. President Franklin Delano Roosevelt addresses a joint session of United States Congress. It is typically identified as a photo of Roosevelt's "Infamy" speech, December 8, 1941, however this has been disputed. It is also possible that this photo was actually taken during his "Four Freedoms" speech (State of the Union address, January 6, 1941) or his 1942 State of the Union address (January 6, 1942). Photo 208-CN-3992 (Photo credit: Wikipedia)

President Franklin D. Roosevelt

"The real truth of the matter is, as you and I know, that a financial element in the large centers has owned the government ever since the days of Andrew Jackson."

John Kenneth Galbraith

The study of money, above all other fields in economics, is one in which complexity is used to disguise truth or to evade truth, not to show it." Money: Whence it came, where it went - 1975,

The process by which banks create money is so simple that the mind is repelled." Money: Whence it came, where it went - 1975,

Georgetown professor Dr. Carroll Quigley (Bill Clinton's mentor while at Georgetown)

"... nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the worlds a whole... controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent private meetings and conferences."

BOB PRECHTER

"I cannot morally blame all Americans for allowing, for instance, the birth of the Federal Reserve System (a private cartel with full control over the issuance of national debt) and the money destruction that has followed. They are simply ignorant about it and don't know what happened or what is happening. They think that prices go up rather than that dollars go down. Unsound money imposes an environment of immorality, which in turn makes people behave in different ways for reasons they know not. Sometimes you can blame immorality for the imposition of bad structures (bad people do it with full knowledge of what they are doing), but sometimes it is simply stupidity. People revere democracy, but democracy ends in plunder by the majority. Are people immoral for supporting democracy? I think rather that they lack a deep understanding of its essence. At a very deep level, I would say that the reason such structures are created is due to both a lack of knowledge and a false morality, which in turn is due to a lack of knowledge."

REP. HOWARD BUFFETT

"The gold standard acted as a silent watchdog to prevent 'unlimited public spending.' Our finances will never be brought in order until Congress is compelled to do so. Making our money redeemable in gold will create this compulsion."

". . . when you recall that one of the first moves by Lenin, Mussolini and Hitler was to outlaw individual ownership of gold, you begin to sense that there may be some connection between money, redeemable in gold, and the rare prize known as human liberty. Also, when you find that Lenin declared and demonstrated that a sure way to overturn the existing social order and bring about communism was by printing press paper money, then again you are impressed with the possibility of a relationship between a gold-backed money and human freedom."

Encyclopaedia Britannica, 14th Edition

"Banks create credit. It is a mistake to suppose that bank credit is created to any extent by the payment of money into the banks. A loan made by a bank is a clear addition to the amount of money in the community."

$531-Trillion Derivatives Market / Alan Greenspan #1 Culprit / Follow the Money (Photo credit: 666isMONEY ☮ ♥ & ☠)

ALAN GREENSPAN

"The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit.... In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. There is no safe store of value.... Deficit spending is simply a scheme for the "hidden" confiscation of wealth.... [Gold] stands as a protector of property rights."

"This is the shabby secret of the welfare statists' tirades against gold. Deficit spending is simply a scheme for the "hidden" confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists' antagonism toward the gold standard."

Related articles

How the Paper Money Experiment Will End(southweb.org)

How the Paper Money Experiment Will End(southweb.org) Ron Paul - Wealth is Not Paper Money(tradethenewsroom.com)

Ron Paul - Wealth is Not Paper Money(tradethenewsroom.com) What Drives The Culture Of Greed And Immorality?(personalliberty.com)

What Drives The Culture Of Greed And Immorality?(personalliberty.com) Here's The Answer To Why Bitcoin Has Value(businessinsider.com)

Here's The Answer To Why Bitcoin Has Value(businessinsider.com)